do you have to pay taxes on inheritance money in wisconsin

The personal representative distributes the remaining assets to the heirs and transfers title. The personal representative files tax returns and pays any taxes owed as well as any other debts.

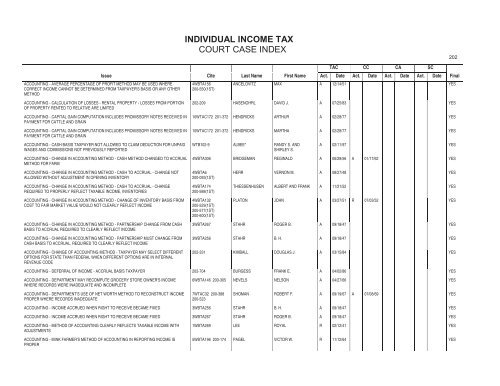

Court Case Index Individual Income Tax Wisconsin Department Of

During that period a.

. A 100000 salary in the Badger State is gnawed down to 70142 by federal and state taxes with 595 of that six-figure income going to the states income tax. How Long Do You Have to File Probate After a Death in North Carolina. This process is called probate.

Living Trust Tax After Grantors Death. To me 5050 is a lot more than 20 percent. August 4 2019 at 1123 am.

The executor of your estate a trusted person you pick in your will is in charge of making sure everything is taken care of. The Revocable Trust tax implications following the death of. After the Grantors death the Trust remains in place and continues to hold legal ownership of all the Trust assets.

The Grantor would still pay taxes on the income of the Trust but would do so through the Trusts own tax return filed under the Trusts EIN number. While there are exceptions it is expected that probate will be filed within 60 days of a persons death. Her choice so so many women girls get left cause daddy.

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Be informed and get ahead with. Theyll handle your assets give your family their inheritance and pay off your debt if necessary.

Its the children that suffer. Lets say you had 100000 of debt when you died but you also had a paid-for house worth 200000. This means that a court-appointed administrator will compile all of the deceaseds assets pay any debts or taxes and distribute what remains to.

Some people need to get out of calculator and do the math on that and then do the math on 20 of your income that you have to pay and see which one weighs out the best. If you dont like the taxes in Wisconsin at least youve got beer cheese and the Green Bay Packers to take your mind off the pay youre losing. She has been in the accounting audit and tax profession for more than 13 years working with individuals and.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

The 10 Happiest States In America States In America Wyoming America

Capital Gains Tax In Wisconsin What You Need To Know

States With Highest And Lowest Sales Tax Rates

Wisconsin Capital Gains Tax Everything You Need To Know

What Is The Estate Tax And How Does It Work Wisconsin Attorneys Ruder Ware

What Is An Irrevocable Trust Infographic Https Www Assetprotectionpackage Com What Is An Irrevocable T Revocable Trust Types Of Trusts Setting Up A Trust

Wisconsin Income Tax Calculator Smartasset

Wisconsin Retirement Tax Friendliness Smartasset

The Ultimate Estate Planning Checklist Funeralplanning Funeralplanningchecklist Funeralpl Estate Planning Checklist Estate Planning Funeral Planning Checklist

Court Case Index Individual Income Tax Wisconsin Department Of

Wisconsin Capital Gains Tax Everything You Need To Know