nys workers comp taxes

File a C-3 employee claim form online complete as many fields with as much detail as you can and submit. No other documents are.

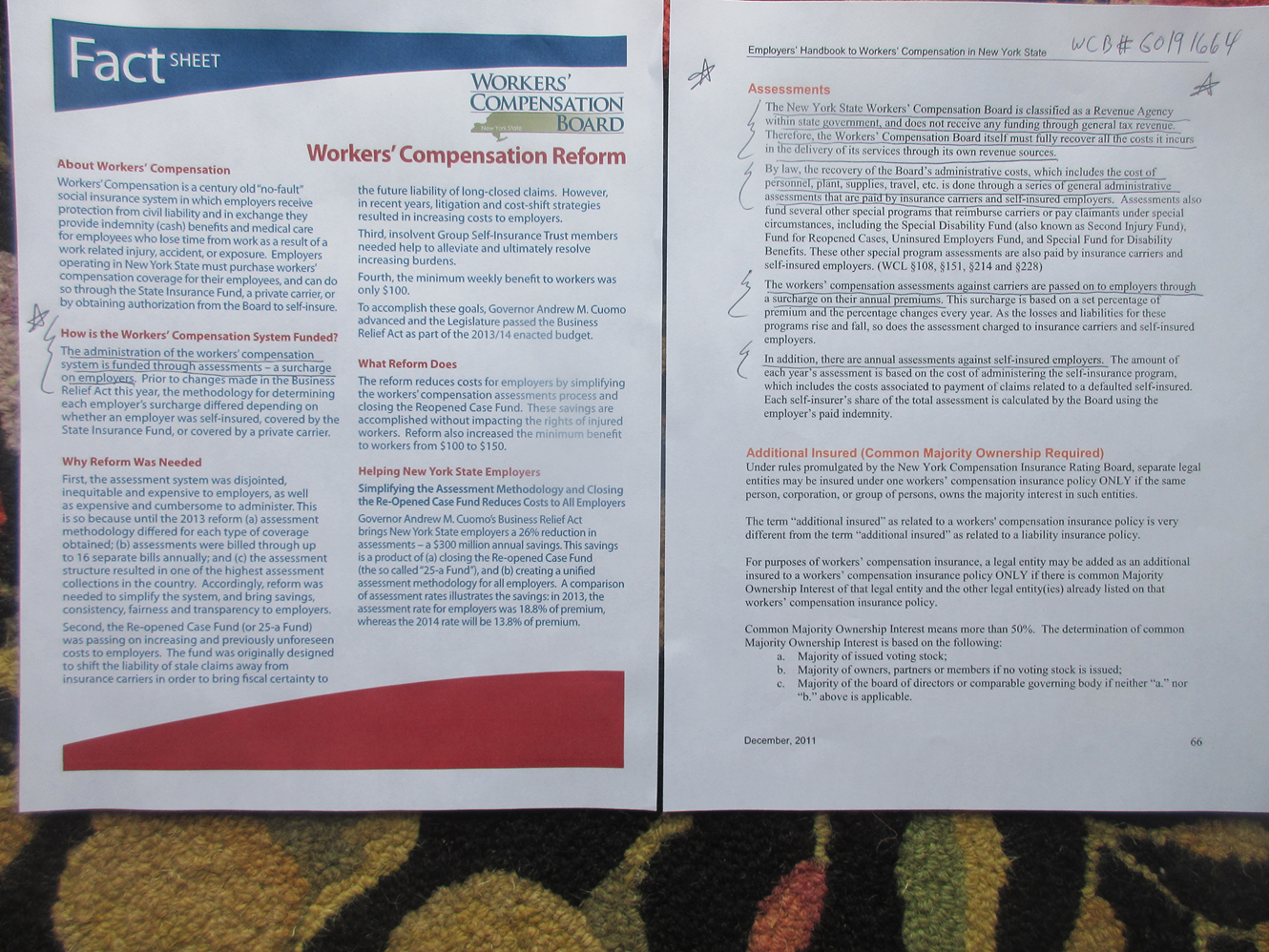

New York Workers Compensation Handbook Lexisnexis Store

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of 114400 for rating their overall workers.

. Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700. Verified Generally workers comp payments are not taxable income. The workers compensation board may also assess other penalties for noncompliance.

The quick answer is that generally workers compensation benefits are not taxable. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. 63 rows A recent study conducted by the Department of Consumer Affairs indicates that New York is currently the 4th highest state on average for workers comp rates.

Nys Workers Comp Rates Oct 2022. This program is designed to offer the medical community the opportunity to engage in industry standard submission of the CMS-1500 to the Workers Compensation Board. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable.

Taxable premiums include all amounts received as consideration for insurance contracts or reinsurance contracts and include premium deposits assessments policy fees membership. The amount that a claimant receives is not decreased by hisher carelessness nor increased by an employers. In a workers compensation case no one party is determined to be at fault.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Falsifying business and employee records or otherwise misrepresenting workers compensation. Also under IRS regulations non-taxable workers.

How does workers comp affect tax return. The amount of workers compensation that becomes taxable is determined by how much the Social Security Administration SSA reduces your disability payments. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors.

Workers Compensation Information for Employers. Workers compensation benefits are not counted as taxable income on both the state and federal level. Employers are required to obtain and keep in effect workers compensation coverage for all employees even part-time employees and family members that are employed.

The information on the 1099-G tax form is provided as follows. I deal with all levels of tax planning and controversy - from the ordinary to the complex. This includes lump sum.

Nys Workers Comp Rates - If you are looking for a way to find different types of quotes then try our popular online service. Access detailed information and helpful resources for employers regarding Workers Compensation. OSC reports both wage and tax adjustments to the Federal government as a W2C correction.

The Statute of Limitations for reporting these adjustments is 3 years 3 months and. Refer to this step by step process to file your claim.

Employers Fund The Nys Workers Compensation System Ny Fbi So To A Reasonable Person This Sounds By Timgolden Medium

Essential Guide Ny Film Tax Credits Wrapbook

![]()

Comp Official Allegedly Stretched Day Of Leave Into Yearlong Loot Business Insurance

![]()

N Y Lawmakers Aim To Give Real Estate Tax Exemption To Injured Workers Business Insurance

Are Workers Compensation Benefits Taxable In New York

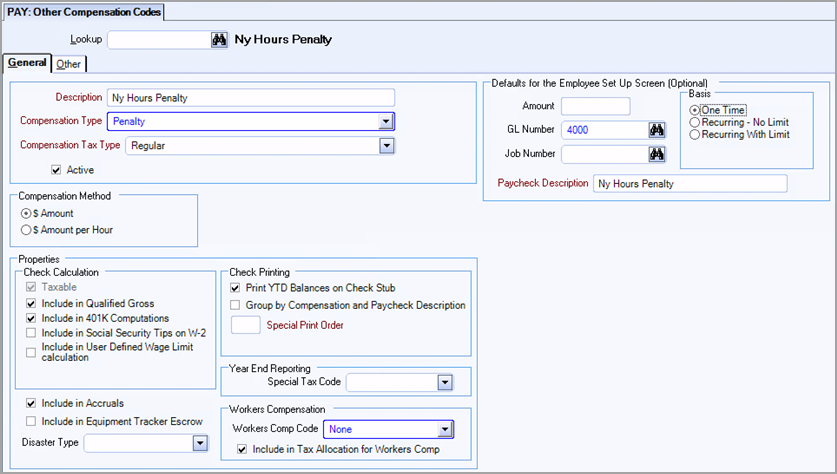

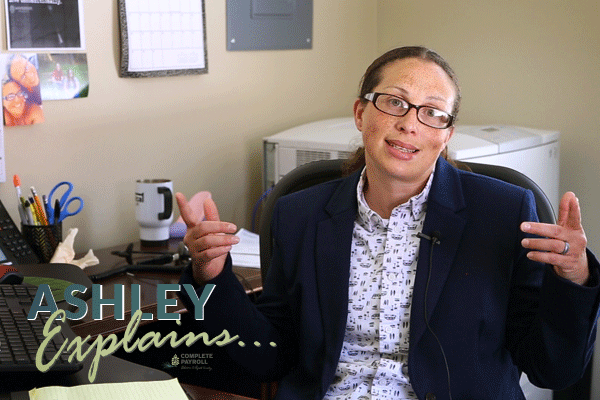

Ecep Ecet What Employers And Employees Need To Know About New Nys Payroll Tax Ashley Explains 06

New York Workers Compensation How It Works

New York Budget Gap Options For Addressing New York Revenue Shortfall

Employer Compensation Expense Tax About New York State S New Payroll Tax

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

New York State Workers Compensation Board Youtube

Workers Compensation Lawyer Nyc The Platta Law Firm

New York Budget Gap Options For Addressing New York Revenue Shortfall

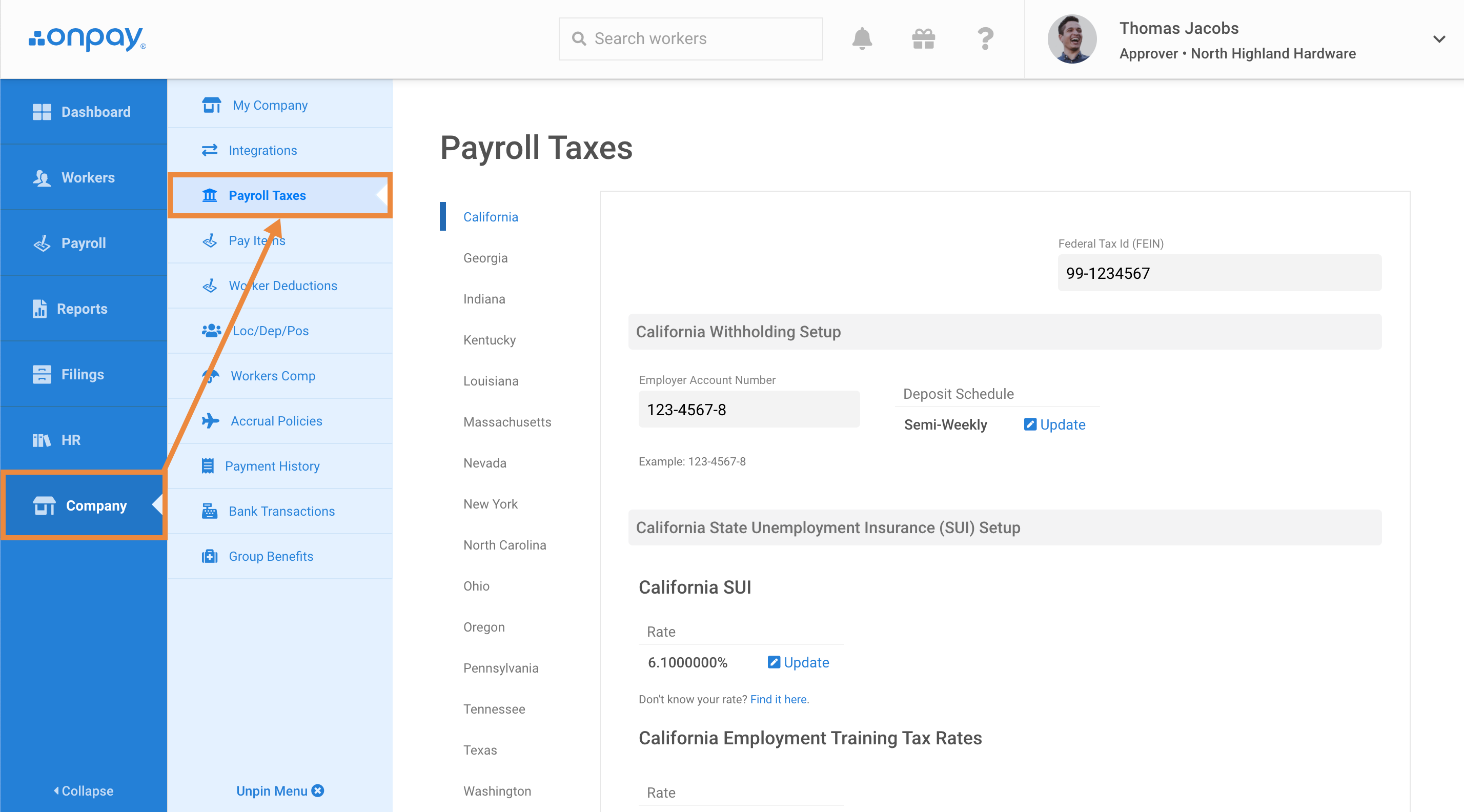

Add Or Update State Payroll Tax Information Help Center Home

Are Workers Compensation Settlements Taxable